Services

Personalized wealth management services tailored to your needs.

A Passionate Commitment to Personal Service

Based in Santa Monica, California, Sierra Investment Management has been dedicated to helping investors manage their wealth for over three decades. We are committed to the highest level of client service, and, throughout your relationship with Sierra, your needs are our first priority.

Our Services Include:

- Personalized service and assistance – when you call, you’ll speak with someone you know and who knows you. We offer one-to-one help with services such as monthly income needs, tax reporting, withdrawals and transfers.

- Client reporting and timely investment insights from the Investment Management Team regarding performance and trends. Client reports are issued quarterly or more often, if needed.

- Personal meetings to review your investment goals, suitability, account allocations, and performance with a frequency that meets your needs.

- Client events and other opportunities to help keep you informed and connected with the Investment Management Team, client service associates, and other Sierra clients.

Ask us for information about tax advantaged investment strategies and programs.

- Municipal Bond Program

- California Municipal Bond Program

- Private Placement Variable Annuity (PPVA)

- Donor Advised Funds

Ways We Can Help

Tax Efficient Investing*

Maximize your returns with our tax efficient investing options, offering tax-exempt dividends and interest at both state and federal levels.

*Any capital appreciation incurred as a result of the Sierra Programs would be taxable.

Provide Investment Counsel During Important Life Events

Guidance through major life events such a sale of a business, property transactions, divorce, or loss of a spouse to help maintain your financial stability.

Personalized Cash Flow Analysis

Analysis of your finances with the goal of creating a tailored cash flow plan to ensure your spending aligns with your financial goals.

Explore a tax-deferred account for investors who no longer qualify for IRA contributions

Qualified accredited investors may benefit from private placement variable annuities (PPVA), which offer tax deferred growth without required minimum distributions until age 90 or older.

Set Up a Donor-Advised Fund and Build a Giving Legacy

Create a lasting impact with a donor-advised fund, a simple and tax-advantageous way to support your cherished charities.

Access to Potentially Cost-Effective Solutions via our Schwab Bank Services Relationship:

Unlock discounts on mortgage rates, access liquidity without selling investments, and manage trust assets effectively through our Schwab Bank Services relationship.

Additional Information

Donor-Advised Fund Solutions

A simple, flexible and tax-efficient option to donate to your favorite charities.

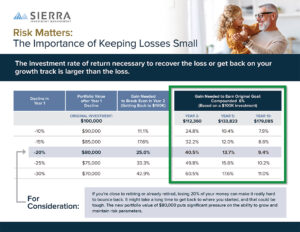

Risk Matters: The Importance of Keeping Losses Small

If you’re close to retiring or already retired, losing 20% of your money can make it difficult to bounce back.

Ways We Can Help

We’re here to help find opportunities that help you make the most of what you’ve built.

Contact Us

If our tactical, rules-based investment process aligns with your needs, we welcome the opportunity to help manage your wealth.