Strategic Income

Program

The Sierra Strategic Income Program (the “Program”) has two objectives, to provide total return and to limit exposure to downside risk.

The Program offers exposure to an income-oriented portfolio. Income-oriented asset classes include, but are not limited to, government bonds, corporate bonds, floating rate notes, preferred securities, convertibles and master limited partnerships (MLPs). The Program may hold funds that primarily invest in either investment grade or non-investment grade securities.

The Program seeks to participate opportunistically in global uptrends in income-oriented funds, while aiming to limit downside risk. Sierra programs directly hold registered funds (“Funds”). Exposure to equity, fixed income, or cash allocations are therefore viewed through the underlying holdings of each Fund directly held in Sierra Programs on a look-through basis.

Tactical Bond

Program

The Sierra Tactical Bond Program (the “Program”) has two objectives, to provide total return and to limit exposure to downside risk.

The Program offers exposure to high yield corporate bonds and long-term Treasuries. The Program will tactically allocate between high yield corporate bond funds, long-term Treasury funds, and cash equivalents and/or short term bond funds.

The Program seeks to participate opportunistically in bond market uptrends. When high yield corporate bonds are in an uptrend, the Program will be invested across several high yield corporate bond funds. When high yield corporate bonds are not in an uptrend, the Program may invest in long-term Treasuries, provided that long-term Treasuries are in an uptrend. Sierra programs directly hold registered funds (“Funds”). Exposure to equity, fixed income, or cash allocations are therefore viewed through the underlying holdings of each Fund directly held in Sierra Programs on a look-through basis.

High Yield Corporate

Bond Program

The Sierra High Yield Corporate Bond Program (the “Program”) has two objectives, to provide total return and to limit exposure to downside risk.

The Program offers exposure to high yield corporate bonds. The Program will tactically allocate between high yield corporate bond funds and cash equivalents and/or short term bond funds.

The Program seeks to participate opportunistically in high yield corporate bond market uptrends. Sierra programs directly hold registered funds (“Funds”). Exposure to equity, fixed income, or cash allocations are therefore viewed through the underlying holdings of each Fund directly held in Sierra Programs on a look-through basis. Sierra programs directly hold registered funds (“Funds”). Exposure to equity, fixed income, or cash allocations are therefore viewed through the underlying holdings of each Fund directly held in Sierra Programs on a look-through basis.

Municipal Bond

Program

The Sierra Municipal Bond Program (the “Program”) has two objectives, to provide total return and to limit exposure to downside risk.

The Program offers exposure to municipal bonds of any credit quality and maturity. The Program will tactically allocate between municipal bond funds and cash equivalents and/or short term bond funds. The Program may also invest in state-specific municipal bond funds.

The Program seeks to participate opportunistically in municipal bond market uptrends. Sierra programs directly hold registered funds (“Funds”). Exposure to equity, fixed income, or cash allocations are therefore viewed through the underlying holdings of each Fund directly held in Sierra Programs on a look-through basis.

California Municipal

Bond Program

The Sierra California Municipal Bond Program (the “Program”) has two objectives, to provide total return and to limit exposure to downside risk.

The Program offers exposure to California municipal bonds. The Program will tactically allocate between California municipal bond funds and cash equivalents and/or short term bond funds. The Program will invest in both investment grade and non-investment grade California municipal bond funds. The Program may also invest in national municipal bond funds.

The Program seeks to participate opportunistically in California municipal bond market uptrends. Sierra programs directly hold registered funds (“Funds”). Exposure to equity, fixed income, or cash allocations are therefore viewed through the underlying holdings of each Fund directly held in Sierra Programs on a look-through basis.

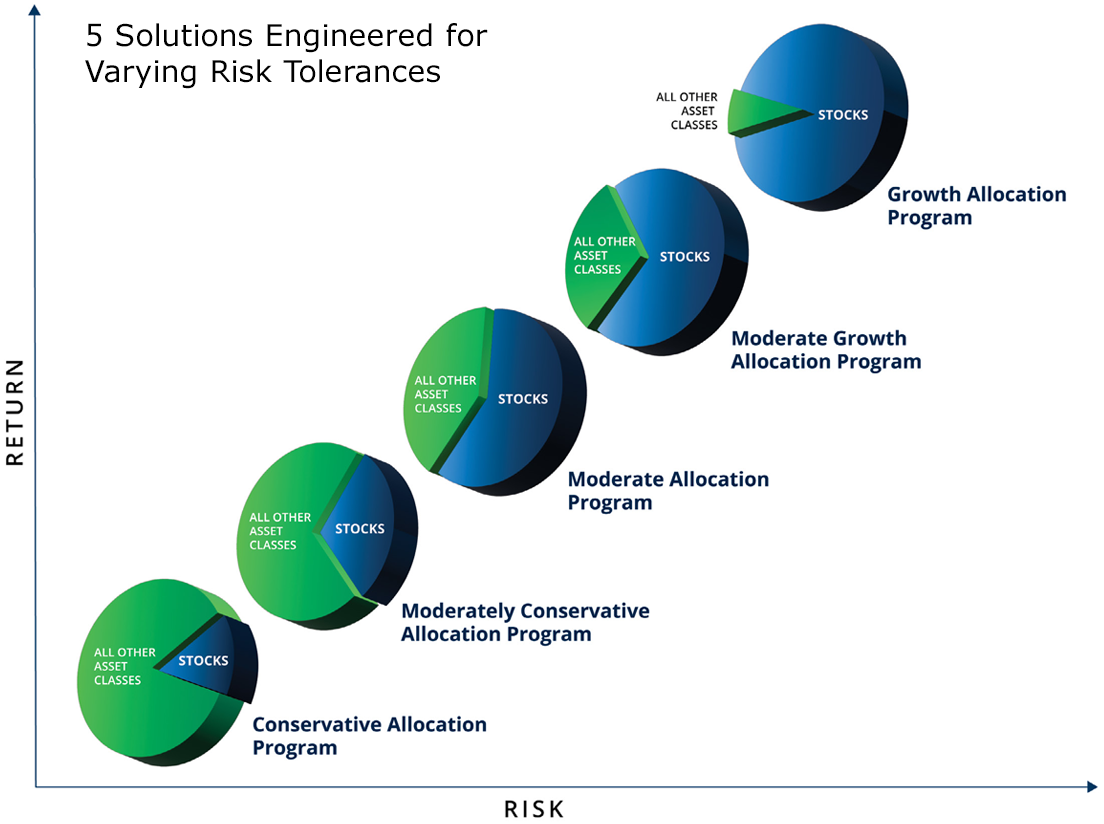

Investments are made through registered funds. “Stock” allocations depicted are representative of equity allocated funds. Additional information on each program is available upon request. Allocations and holdings are subject to change at any time. For illustrative purposes only. Results may differ materially.